If you’re doing any sort of business online, then you need to have a way to accept and process credit card payments. This review is going to:

- Introduce you to your main options for accepting payments online.

- Provide you with a checklist when you start shopping around.

- Review the top five payment gateway processors.

So let’s get started…

What Are The Different Ways To Process Payments?

We have a lot of people who ask, what is the difference between a merchant account, a payment gateway and a payment processor?

Here’s a quick explanation…

There are four parties involved with every credit card transaction:

- The merchant.

- The customer.

- The acquiring bank that provides the merchant’s processing services.

- The issuing bank that issued the customer’s credit card or debit card.

Here’s how payment gateways, merchant accounts and payment processors differ in how they process these payments:

PAYMENT GATEWAYS

A payment gateway securely enables you (the merchant) to take credit/ debit card payments from your customers directly from your website. If the payment is happening in-store, it usually is a POS (point of sale) physical card terminal machine that performs this action.

Examples of payment gateways include PayPal, Stripe, Amazon Payments, and Authorize.net.

MERCHANT ACCOUNTS

A merchant account is a special type of bank account that works behind the scenes to receive debit and credit card payments after a payment has been made through a payment gateway, physical card terminal, or a virtual terminal. It is different from your normal business bank account, and it doesn’t need to be with the same bank.

Examples of merchant account providers include First Data Merchant Services, and WorldPay.

PAYMENT PROCESSORS

The payment processor executes the transaction by transmitting data between you (the merchant), the issuing bank (i.e., the bank that issued your customer’s credit card), and the acquiring bank (i.e., your bank).

Payment processors are the financial institutions that work in the background to provide all the payment processing services used by an online merchant.

So to sum up…

To accept payments via your website, you need both a payment gateway (to securely verify the funds) and a merchant account (to receive the funds).

All-In-One Services

Some providers offer these two together they are called “all-in-one payment service providers.”

Examples: payment gateway services such as PayPal and Stripe are effectively a payment gateway and merchant account combined, as you don’t need a separate merchant account.

Pros:

- Quick and easy to get set up.

Cons:

- Rate is fixed and not negotiable.

- May not be a cost effective solution for large volume merchants.

Separate Payment Gateway

and Merchant Account

Some providers offer payment gateways and merchant accounts as separate services. You can get them from the same provider or from different providers.

Pros:

- Rate may be negotiable.

- Negotiating could be a significant cost saving solution for large-volume merchants.

Cons:

- Can be costly for smaller merchants due to the fixed monthly fees.

- Application can take weeks, and it’s not easy to get approval.

As you start reviewing different options, you’re going to want to use this checklist to be sure you don’t miss anything…[su_note note_color=”#daeaf2″ text_color=”#1a2323″ radius=”0″]

Payment Gateway Checklist

- Is the payment gateway supported on your shopping cart platform?

Ask yourself:

- Which shopping cart/ ecommerce platform are you going to be using?

- Are you going to use a hosted solution like Shopify or BigCommerce…?

- Or a self-hosted platform like WooCommerce or Magento?

It is best to choose a payment gateway that already is supported by or integrated with your platform.

- Do you want a payment gateway and merchant account or an all-in-one payment service provider?

Getting an account with one of the combined providers tends to be easier than getting a merchant account, and is also tends to involve fewer setup and monthly fees. The per-transaction fees tend to be higher, however. For these reasons, small merchants may want to start with a combined payment provider. Larger merchants can typically save money by having their own merchant account.

- Will you be dealing with one-off payments and/or recurring subscriptions?

Are you accepting recurring payment as well? Then look for a provider that supports both one-off and recurring billing.

- Which payment methods or card types does your target market currently use?

Make sure to understand which payment methods or card types people in your target market like to use, and then choose a payment gateway with support for those methods.

Ideally, the payment gateway should accept all major credit cards so you won’t lose customers or money due to the fact that your service doesn’t process those cards.

- Is the provider PCI Compliant?

Make sure the provider is compliant with the DSS (Data Security Standards) established by the PCI (Payment Card Industry) so that you don’t run into legal problems for not being PCI compliant.

- Does the provider have a good reputation?

Payment processing is critical to your business, so you’ll want to work with a provider who has a good reputation in the industry.

High-quality customer service support is also vital so that you can get the help you need to keep your business up and running.

- Does the provider allow on-form payments?

Ideally, the payment form and check out step should be a seamless experience for the customers. However, not all providers support on-form one-page check out.

Note: iFrame embedding or redirecting to a secured, hosted payment page is still a widely used method. You get the form code from your payment gateway and embed this code on your site. Or you simply redirect customers to a secured hosted payment page.

The drawback of this method is that the hosted form usually doesn’t match or look uniform with your site design, which can create trust issues and lower conversion rates. Also, forcing the customers to go through too many steps to check often results in them abandoning their shopping cart before the payment is complete.

- Does the provider show pricing transparency & consistency?

Payment gateways and merchant accounts charge various fees such as:

- Transaction fees (fixed or variable).

- Set up fees.

- Monthly fees.

- Chargeback fees.

- Fees to accept payments from international cards.

And more. You need to be sure you completely understand and accept all fees before you sign up with a service provider. You’ll need to:

- Ask to see a full list of charges so that you can accurately calculate your cost.

- Make sure to read ALL their terms and fine print.

In addition, keep these points in mind:

- Look for providers that offer transparent pricing and post their fees, costs and terms on their websites.

- Avoid lengthy contracts and look for a month-to-month service that’s up-to-date with the latest payment technology and is PCI compliant.

- Be sure your chosen provider doesn’t restrict or prohibit your type of business or the type of product you’re selling.

- Credit card data portability: What if you decide to leave the service? Can you bring the data with you? Is there a fee? What is the process?

And vice versa: can you import your existing card data to the new provider?

Note: in order to ensure PCI compliance, and the integrity of the data, it’s important that card data pass directly from one PCI-compliant payments provider to another. If you handle the card data, your company could fall into legal problems for not being PCI compliant (and even worse, you put your customers’ data at risk).

- Can you accept transactions on a mobile device?

Mobile payment (m-payment) is a point-of-sale (PoS) transaction made or received with a mobile device. This allows you to take your business with you wherever you go, such as to trade shows or other events.

Reviews of The Top Five Payment Gateways

So now that you know what to look for when you’re comparing service providers, it’s time to take a closer look at your options. Inside this review we’re going to share our experiences and thoughts about five popular payment gateway options, including:

Which one is right for you? Let’s find out…

2Checkout Payment Gateway Review

2Checkout (or often called 2CO) was founded in 1999. Today, it’s a leading global payment platform that supports over 50,000 merchants in 211 markets and 87 currencies.

Let’s take a look at 2Checkout’s main features to see if it’s right for you…

All-in-one payment service provider?

Yes.

2Checkout is a service that’s very similar to competitors such as PayPal and Amazon payments, but with one major difference: it does not solicit the merchant’s customer to sign up for a 2Checkout account. Instead, it simply lets the customer complete their transaction with their debit or credit card, with no addition steps or solicitations.

Fees

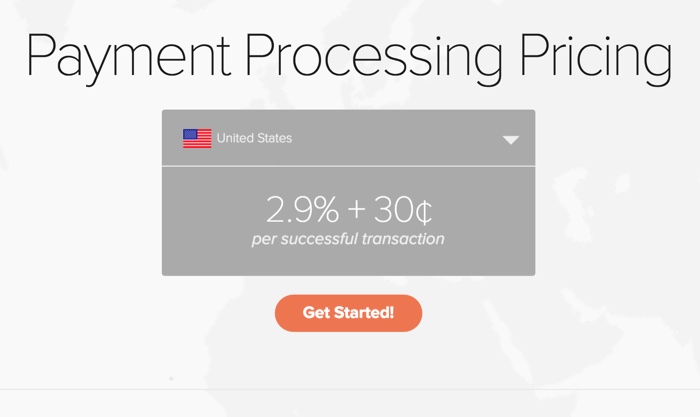

2Checkout’s fees are pretty straightforward:

Monthly fee: None. This is a good feature for low-volume merchants, or those who are just getting started.

Debit and credit rate: 2.9% of the transaction price, plus a 30 cent fee on every transaction.

Non-US payment for US sellers: 3.9% plus a 30 cent fee on every transaction.

International sellers: $10.99 set up fee, and 5.5% plus 45 cents per transaction.

Early termination fee: None.

PCI compliance fee: None.

NOTE: PCI refers to the Payment Card Industry Data Security Standard. This is a 12-point compliance system, including building and maintaining a secure network, hosting on PCI compliant servers, protecting cardholder data, transmitting encrypted data, and so on. Some payment gateways pass this compliance fee directly onto their customers.

Equipment lease term: None.

Chargeback fee: $20.

Other Notes:

2Checkout provides volume discounts to merchants who process more than $50,000 per month.

Funds are deposited into your account once per week. You have the option to get paid via wire transfer, bank transfer or Payoneer Master card.

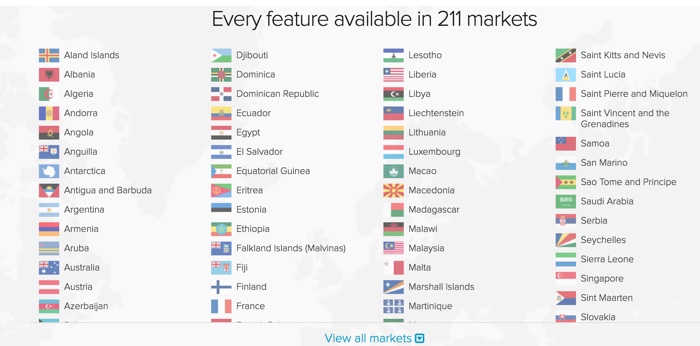

Supported Countries

2Checkout is accepted and processed in 211 markets in countries around the world, including:

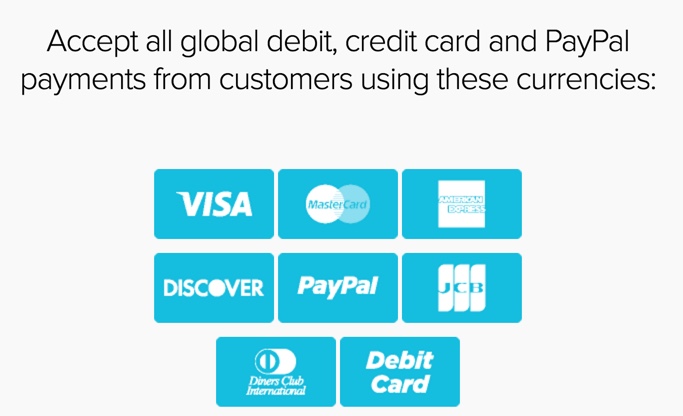

Major Credit Cards Supported

2Checkout supports all major credit cards including Visa™, MasterCard™, Discover™, American Express™, Diner’s Club International™, JDB™, PayPal™ and debit cards.

2Checkout accepts 87 currencies, and can make these transactions in 15 languages.

Recurring Billing

Yes, 2Checkout offers recurring billing, and there is no fee for this feature.

So whether you have a monthly membership site, or you just need to have customers renew once per year, 2Checkout can handle these recurring payments.

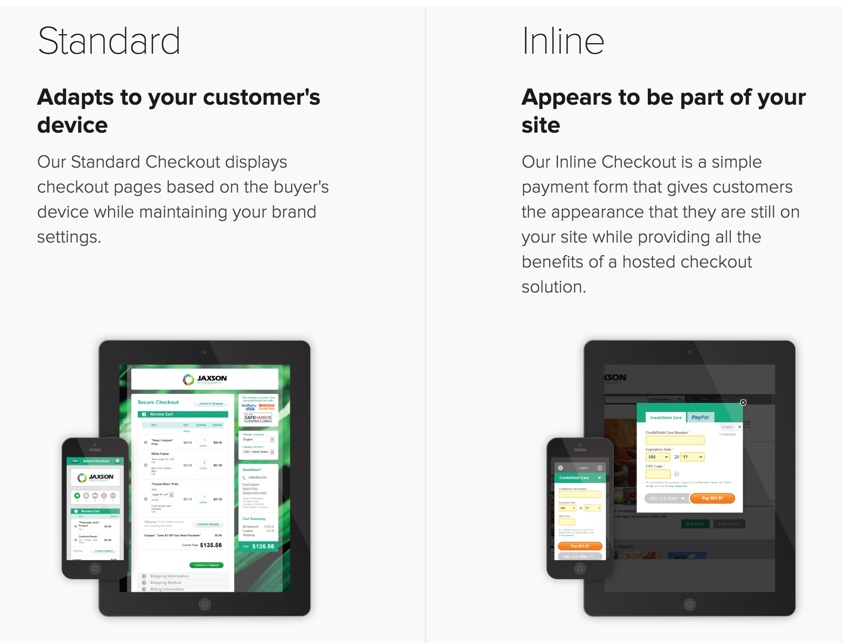

On-Site Payment

Yes, you can elect to install a beautiful on-site checkout form, although some programming knowledge is required. Alternatively, you can choose hosted checkout solution that gives your customers the appearance they are still on your site. Either way, you get a boost to your conversions because customers will see and trust your brand while enjoying a good ordering experience.

Security and PCI Compliance

Yes, 2Checkout has Level 1 compliance, which is the highest compliance level for the Payment Card Industry Data Security Standard. And that means that both you and your customers are protected from fraud.

Can you accept phone orders or manually enter your customers’ payment info? No, this feature is not available.

Platform Integrations

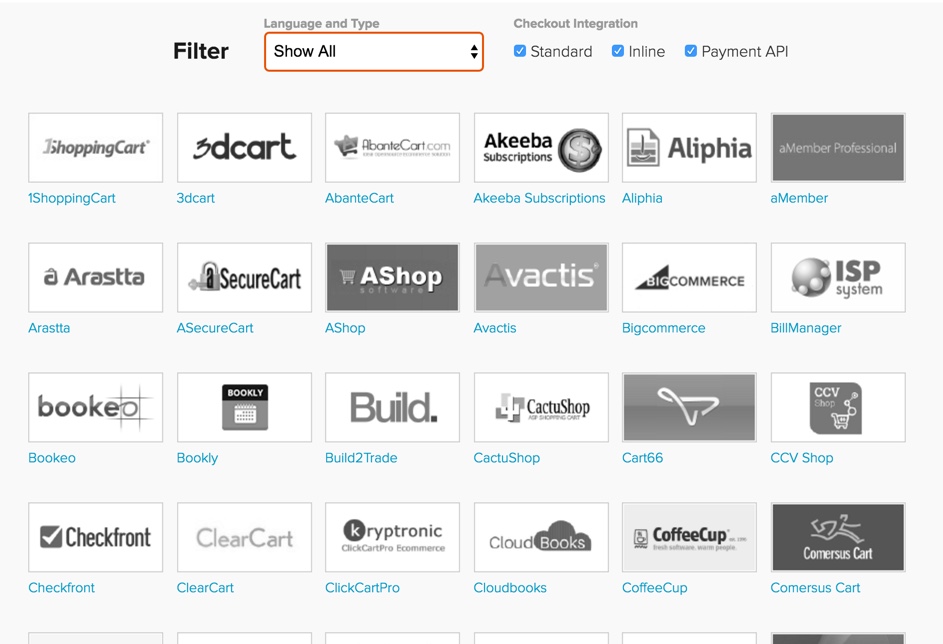

2Checkout is a widely supported platform, with over 100 other platforms integrating with it. This includes the industry’s top shopping carts, such as Magento, Open Cart, Instant Store, Woo Commerce, Zen Cart over 95 others.

Chances are your favorite shopping cart is supported, too.

Mobile Payments

Can you accept 2Checkout payments from your customers in person using your mobile phone?

This is possible, depending on your history and on final approval from 2Checkout. Generally, you’ll need at least three months’ of sales history with 2Checkout before you can be approved for a Virtual Terminal. You’ll need to contact 2Checkout’s customer service to acquire this approval.

Credit Card Data Portability

Can you export data if you decide to leave the platform? No.

Can you import card numbers from your existing provider to this provider? We were unable to confirm this. Please check with 2Checkout customer service with the details of your needs.

Who Can Use 2Checkout as a Payment Gateway?

2Checkout is a great option for small to mid-size businesses, as you can get started with a nice set of features for no additional charge and no monthly maintenance fees.

Support

What Type Of Support Is Offered?

If you ever have a problem, you can reach 2Checkout’s support team via both a help desk and the telephone.

What Type of Reputation Does The Provider Have In The Market?

2Checkout has a rock solid reputation in the field, as they’ve been providing payment processing services since 1999. Today they provide services for over 50,000 merchants.

They have a Better Business Bureau rating of A+. At the time of this writing, there are 48 complaints closed with the BBB in the last three years, and 15 of those were closed in the last 12 months. When you consider that they have 50,000 customers, these complaint numbers are VERY low – and that’s a good sign.

2Checkout is a leading global payment platform and if you’d like to learn more about this service, check out their website by clicking the button below.

Now let’s take a look at another popular payment gateway…

Amazon Payments Gateway Review

Amazon Payments, which officially launched in 2007, is a wholly owned subsidiary of Amazon.com. Their focus is on giving merchants’ customers the same payment experience enjoyed by Amazon customers.

Let’s take a look at their features to see if it’s a good fit for your business…

All-in-one payment service provider?

Yes

Amazon Payments is a payment service that allows Amazon.com customers to pay for purchases on other websites using their Amazon.com account. That means all your customers have to do is log into their Amazon accounts to pay you – they don’t need to enter their payment information or credit card numbers.

The benefit is that you get to use Amazon’s trusted brand to process payments – and it’s easy for Amazon customers. The downside, of course, is that not everyone has an Amazon account.

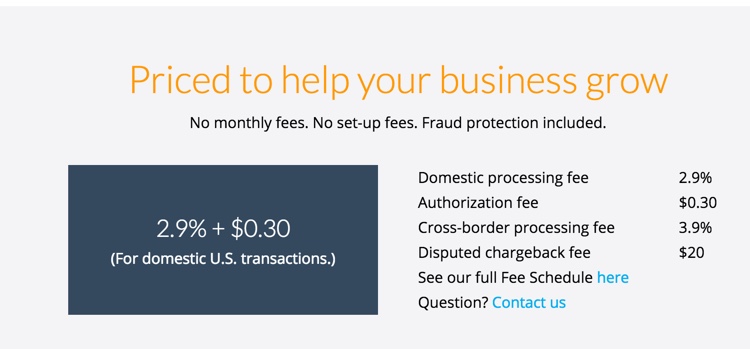

Fees

Here’s a look at Amazon Payments’s fees:

Monthly fee: None.

Debit and credit rate: 2.9% plus 30 cents per transaction.

Non-US payment for US sellers: 3.9% plus 30 cents per transaction.

Early termination fee: None.

PCI compliance fee: None.

Equipment lease term: None.

Chargeback fee: $20.

Note: Funds are held until 14 days after the first transaction. After that, it’s released daily to you, but it could take three to five business days to reach your bank account.

Supported Countries

Amazon Payments offers services to merchants in four countries, including the United States, the United Kingdom, Germany, and Luxembourg.

NOTE: Sellers in the United States must provide social security information as well as their bank account information during the approval process.

Major Credit Cards Supported

All major credit cards are accepted, Visa™, MasterCard™, Discover™, American Express™, Diner’s Club International™, JDB™, PayPal™ and the Amazon (Prime) store card.

NOTE: All credit cards used for billing must have a United States billing address.

Recurring Billing

Yes, this feature is available, and there is no additional fee.

On-Site Checkout Form

Yes, it is possible to integrate the Amazon payment form into your site. However, this does require programming knowledge, and you will need an SSL certificate depending on your chosen integration method.

Security and PCI Compliance

Yes.

If you’re looking for a secure option, Amazon Payments is a good choice. That’s because the customer’s sensitive card data is stores on Amazon’s secure server. The security and fraud protection at Amazon is considered more advanced any other provider. This takes a lot of pressure and liability off of you the merchant. That means you can spend more time closing sales and less time worrying about fraud.

Can you accept phone orders or manually enter your customers’ payment info?

No, you cannot manually key in your customer’s information.

Platform Integrations

Amazon is household name that’s trusted around the country. That’s why more and more shopping carts and platforms are integrating with Amazon Payments, including:

- Woo Commerce

- Shopify

- Open Cart

- Miva[/su_list]

And more.

Mobile Payments

Can you accept Amazon Payments from your customers in person using your mobile phone? No, manual key-in is not supported.

Credit Card Data Portability

Can you export data if you decide to leave the platform? No.

Can you import card numbers from your existing provider to this provider? No.

Who Can Use This Payment Gateway?

This is a good option for many small to mid-size businesses. In particular, those businesses who are still fairly new in their markets may want to use Amazon Payments, simply because using a trusted name and brand like Amazon is one of the best ways to boost conversions.

However, this payment option isn’t available to everyone. It’s only supported in a handful of countries, AND there is a strict approval process that each merchant must navigate.

If you do get approved and you’re a large volume merchant, you can negotiate for a lower fee.

Another benefit of Amazon Payments is that you can accept the Amazon Prime store card, which provides special promotional financing with a purchase of $149 or more. This gives your customers a way to finance their purchases, while still allows you to get paid upfront. Win-win!

What Type Of Support Is Offered?

You can reach support via both the phone and a help desk. In addition, Amazon Payments provides extensive user documentation online, so you can find the answer you need without having to contact support.

What Type of Reputation Does The Provider Have In The Market?

As mentioned, Amazon is a trusted household brand. The Amazon company as a whole has a Better Business Bureau Business Review with an A+ rating. However, Amazon payments doesn’t have a separate business profile with the BBB, and few (if any) of the 8000+ consumer complaints on the Amazon.com profile have anything do with the Amazon Payments service.

However, you can see live case studies posted by merchants who’re enjoying positive results after implementing Amazon Payments on their sites. Check them out at here.

If you would like to see if Amazon Payments is giving merchants’ customers the same payment experience enjoyed by Amazon customers just click the button below. at http://promotelabs.link/AmazonPaymentsNow the next payment gateway…

Authorize.Net Payment Gateway Review

Authorize.net has been providing payment gateway and merchant account services since 1996.

Let’s take a closer to look to see if Authorize.net is good match for you and your business…

All-in-one payment service provider?

No.

Authorize.net is a little different from some of the other providers we’ve talked about, as it does not offer all-in-one services. Instead, you have two options:

- Payment gateway services only.

- Combination of payment gateway and merchant account.

Do note that the merchant account can be one of Authorize.net ’s resellers. However, in these cases the terms and the fees may be quite different from the fees listed on Authorize.net’s website. So be sure to confirm fees and terms before you proceed.

Fees

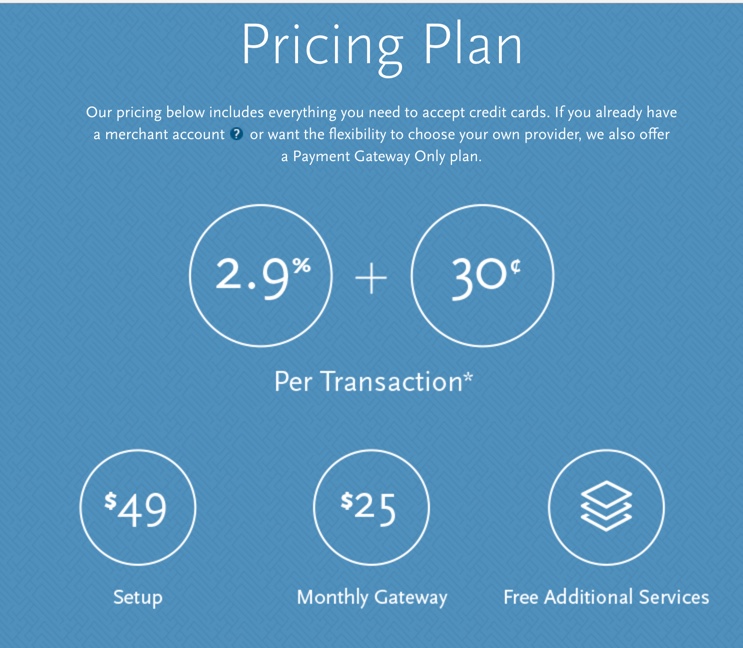

Authorize.net offers two options as listed above, and these two options include different fee structures as follows:

Option 1: Payment Gateway + Merchant Account

Setup Fee: $49

Monthly Gateway Fee: $25

Debit and Credit Rate: 2.9% plus 30 cents per transaction

Option 2: Payment Gateway Services Only

NOTE: With this option, you’ll need to secure a merchant account somewhere else. You’ll be paying for your merchant account fees, as well as paying fees to Authorize.net. So if you choose this option, be sure to find out how much you’ll be paying in fees to your merchant account provider.

Setup Fee: $49

Monthly Gateway Fee: $25

Transaction fee: $0.10

Batch fee: $0.20

Other Fees (For Both Options):

Early termination fee: None

PCI compliance fee: None

Equipment lease term: Varies

Chargeback fee: $25

eCheck.net fee: 0.75% per transaction

Verbal authorization (payment over the phone): $1.20

NOTE: If you sell outside the United States, add a 1.5% assessment per transaction. Funds are held for 48 hours, and then released to the merchant in batches.

Supported Countries

In order to sell using Authorize.net, your business must be domiciled in the United States, United Kingdom, Australia, Canada or Europe. However, you can accept international transaction from customers who are located worldwide.

Major Credit Cards Supported

Authorize.net supports all major credit cards including Visa™, MasterCard™, Discover™, American Express™, Diner’s Club International™, and JDB™.

In addition, you can also accept payment via Apple Pay™, PayPal™, Visa Checkout™, eCheck.net, and signature debit cards.

Recurring Billing

Yes, recurring billing is available at no extra charge.

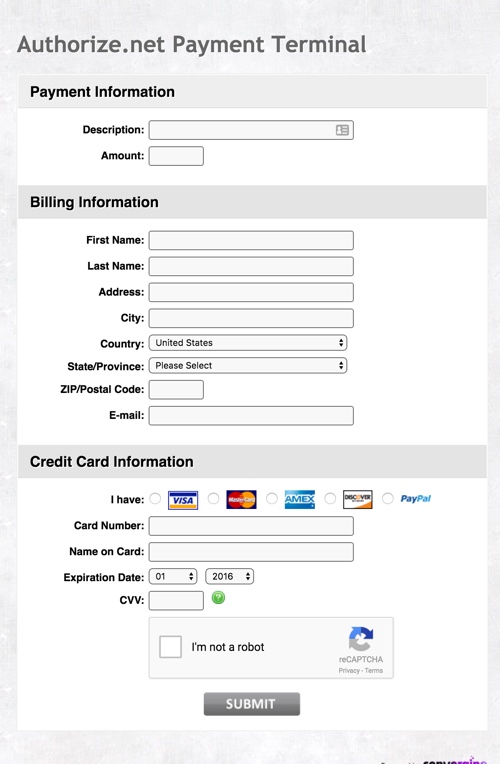

Onsite Checkout Form

Yes, this is possible, but some programming knowledge is required. In addition, you may need to obtain an SSL certificate, depending on the integration method you choose.

Security and PCI Compliance

Yes, Authorize.net is PCI-compliant.

Important: Since Authorize.Net is not directly involved with establishing, evaluating or validating merchant PCI compliance requirements, they have partnered with Trustwave, a leading provider of information security and compliance management solutions. Trustwave offers convenient PCI tools and validation services at a specially discounted price to Authorize.Net merchants.

Can you accept phone orders or manually enter your customers’ payment info?

Yes

Platform Integrations

Since Authorize.net has a long history online, and is considered one of the top service providers in the industry, it is supported by many platforms. These include mobile, online, retail and telephone solutions. Examples include:

-

- ThunderTix

- Auctiva

- QuickCart

- BigCommerce

- Apple Cart

- Pinnacle Cart

- WordPress

- Spark Pay

And many, many more. See the list here

Mobile Payments

Can you accept Authorize.net payments from your customers in person using your mobile phone?

Yes. You’ll need to use an Authorize.net mobile app, or a solution from a third-party. Authorize.net certifies over 50 third-party solutions, so you’re sure to find one that meets your needs.

Credit Card Data Portability

Can you export data if you decide to leave the platform? No, this is not allowed due to security concerns. Here’s what customer service told us:

Can you import card numbers from your existing provider to this provider? No, Authorize.net doesn’t support this feature.

However, some developers and third parties do offer solutions to data portability. See Spreedly.com as an example.

Who Can Use This Payment Gateway?

This is a good fit for mid to large businesses who’ve chosen to use a merchant account, as well as those who want to accept orders over the phone.

Note: Large-volume businesses may also be able to negotiate a lower rate on transactions and fees. Be sure to read and understand Authorize.net’s terms of service and limitations before signing up with them, as they’re not a good fit for all businesses.

What Type Of Support Is Offered?

Authorize.net support staff is available through the Help Desk, telephone, and via live chat (which requires a login).

Note that the help desk and FAQ contain very little documentation. There is a developer community available with posts dating back to 2012.

What Type of Reputation Does The Provider Have In The Market?

Authorize.net is a Visa company that has been providing payment processing services since 1996 for over 400,000 merchants.

Authorize.net has a Better Business Bureau Business Review with an A+ rating. Records indicate that have been 141 complaints in the past three years, with 50 of those complaints being closes in the last 12 months.

While this is a relatively low number of complaints considering the large number of merchants that Authorize.net provides services too. However, these complaints mainly center around poor customer service, an outdated system, and the lack of data portability. These factors may be deal breakers, so Authorize.net may not be the right solution for some business owners.

Authorize.net is a payment gateway that allows you to accept online credit card payments on your website…. So, if you’d like to learn more about whether Authorize.net is the right and reliable solution for you, check them out by clicking the button below. At http://promotelabs.link/AuthorizeNet

Now let’s look at the next service provider…

PayPal Payments Pro Payment Gateway Review

PayPal Payments Pro allows you to accept payments with a completely customizable solution. While PayPal had been developing their payment gateway solution, they acquired Verisign’s Payment Services business in 2005. This gave them a more mature gateway to offer customers.

So let’s take a look at their features and fees to see if this is a good solution for your business…

All-in-one payment service provider?

Yes.

In order to use PayPal Payments Pro, you need to have a PayPal account, and then you need to apply to Pro to get access to all the features. Approval typically takes five to seven business days. No merchant account is needed.

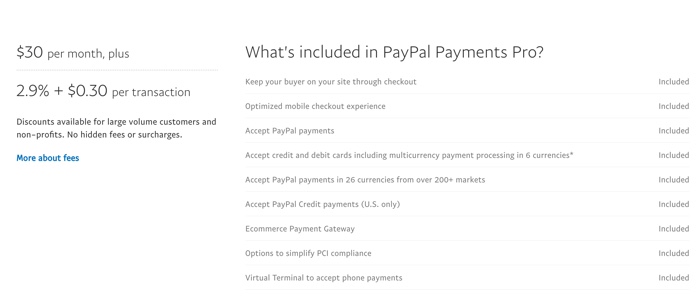

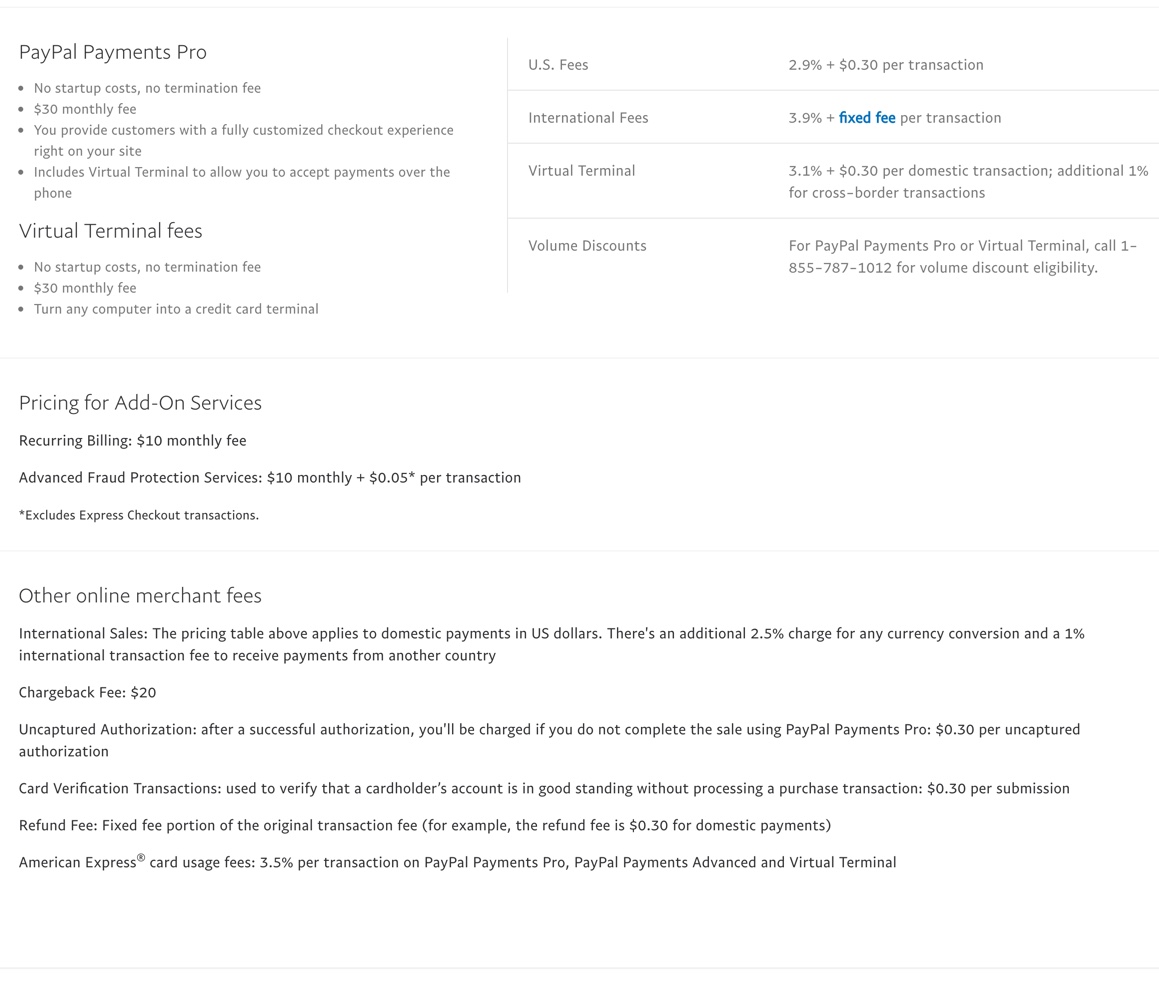

Fees

Debit and credit rate:

Fees vary depending on whether the transaction is a US or international transaction, whether the transaction occurred through the merchant website or a virtual terminal, and what type of card the customer used.

Specifically:

2.9% plus $0.30 per domestic transaction through merchant websites.

3.9 plus a fixed fee per international transaction through merchant websites

3.1% plus $0.30 per domestic transaction through the virtual terminal

4.1% plus $0.30 per international transaction through the virtual terminal

3.5% per American Express transaction

Please note that volume discounts may also be available on an individual basis.

Early termination fee: None

PCI compliance fee: None

Equipment lease term: None

Chargeback fee: $20

Note: PayPal’s “Bill Me Later” financing solution is included at no extra charge.

Be sure to understand all of PayPal Payments Pro’s fees by reviewing them here

Funds will show up in your PayPal account instantly. You can then choose when you want to transfer these funds to your bank account, which typically takes one to three business days.

Supported Countries

In order to use PayPal Payments Pro, you must be in the United States, United Kingdom, or Canada.

Major Credit Cards Supported

Most major credit cards are supported, including Visa™, MasterCard™, Discover™, and American Express™. You can also accept payments via PayPal™ and PayPal Credit™.

What is the difference between PayPal Payments Pro and PayPal Standard?

Many people, especially those who are already using PayPal Standard payments, wonder what the difference is between Standard and Pro.

Here are the main points:

- PayPal Standard is available in 203 countries and markets.

- US fees for the Standard service are 2.9% + $0.30 per transaction.

- Micropayments (which are transactions under $10) are charged at 5% + $0.05 per transaction for Standard payments.

- There are no startup costs or monthly fees to use PayPal Standard.

- The checkout process is handled externally for PayPal Standard, which means you cannot use an onsite checkout form as you can with the Pro version.

- PayPal Standard offers no Virtual Terminal option, whereas this is an option with PayPal Payments Pro.

Recurring Billing

Yes, this is available for a $10 monthly fee.

On-Form Payment

Yes, you can integrate the form into your site, though some programming knowledge and an SSL certificate may be required for this option.

Security and PCI Compliance

Yes, PayPal is PCI compliant. Your customers’ sensitive data is stored on PayPal’s secure servers, which makes it less stressful for the merchant.

Note: to embed on the checkout form on your site requires programming knowledge and an SSL certificate.

Can you accept phone orders or manually enter your customers’ payment info into PayPal Payments Pro?

Yes, one option with PayPal Payments Pro is to have a virtual terminal, which lets you accept orders over the phone. Basically, you can turn any computer into a credit card terminal.

Please take note of the Virtual Terminal Fees:

No startup fee.

$30 monthly fee.

3.1% plus 30 cents per transaction for domestic payments; additional 1% per transaction for cross-border transactions.

Platform Integrations

With numerous plugins and ease of integrations, PayPal Payments Pro is one of the top all-in-one providers. It is widely used and supported by many platforms. You can learn more about integrating here.

Mobile Payments

Can you accept PayPal Payments Pro payments from your customers in person using your mobile phone?

Yes.

If you’re accepting orders over the phone, you can use the PayPal Here app and card reader. For in-person transactions, you can use PayPal’s point of sale solutions. The card readers let you take in-person payments for debit cards, credit cards, magnetic swipes or chip cards.

Take note of the fees when using these solutions:

2.7% per US card swipe.

3.5% + $0.15 to key in cards.

2.9% + $0.30 to invoice.

1% for cross-border transfers

Credit Card Data Portability

Can you export data if you decide to leave the platform? No

Can you import card numbers from your existing provider to this provider? No

If you need to import data, you may consider talking to a third-party service such as Spreedly.com.

Who Can Use This Payment Gateway?

Any business can use PayPal, and that includes businesses of all sizes. What’s appealing to many merchants is that customers are familiar with and trust the PayPal brand. What’s more, customers can pay out of their PayPal balances, which can boost conversions.

Another option that may appeal to merchants with high-ticket products and services is that PayPal lets customers use the “Bill Me Later” option. This financing option lets your customers pay for a purchase on a payment plan, and yet you still get paid the full amount immediately.

What Type Of Support Is Offered?

You can reach PayPal Payments Pro support through the help desk and telephone. Our experience has been very good with their customer support staff. They also have extensive documentation available on their site, including a how-to guide.

What Type of Reputation Does The Provider Have In The Market?

PayPal arrived on the scene in 1998, and has since grown to become a trusted household name. In fact, it’s the most popular provider in the industry. It’s easy to use, especially if you don’t have any technical experience.

PayPal has a Better Business Bureau Business Review with an A+ rating. However, at the time of this writing, there are 5994 complains closed with BBB in the last three years, with 2405 of those complaints closed in the last 12 months.

However, take note of two things: 1) PayPal is a huge company with millions of customers all over the world, and 2) The ratings and complaints refer to PayPal as a whole (not PayPal Payments Pro specifically). Many of the complaints center on issues such as the sudden freezing of merchant accounts or reserves being withheld without notice.

To learn more about whether PayPal Payments Pro is right for you, check them at out by clicking the button below. At http://promotelabs.link/PaypalPaymentsPro

Now let’s look at the final option in our payment gateway review…

Stripe Payment Gateway Review

Stripe specializes in helping those who’re running internet businesses, and they handle billions of dollars in transactions every year for these merchants.

Take a look to see if Stripe is a good fit for your business…

All-in-one payment service provider? Yes. You just need to get a Stripe account in order to get access to all of Stripe’s features. No separate merchant account needed.

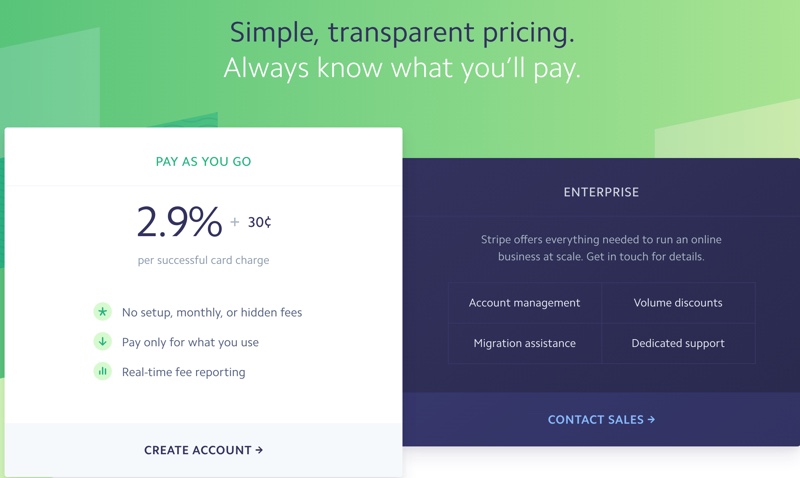

Fees

Stripe comes with a simple, straightforward pricing model.

Monthly fee: None

ACH & Bitcoin Rate: 0.8% (Capped At $5)

Debit & Credit Rate: 2.9% + $0.30

Early termination fee: None

PCI compliance fee: None

Equipment lease term: None

Chargeback fee: $15

There is no monthly fee and no setup fee. When you compare the features you get with Stripe’s flat-rate fees, you’ll find it’s a pretty good deal when compared to the more expensive options such as Authorize.net and PayPal Payments Pro.

Funds are held and then released to a merchant account on a rolling basis every seven days. US merchants receive funds every two days on a rolling basis.

Supported Countries

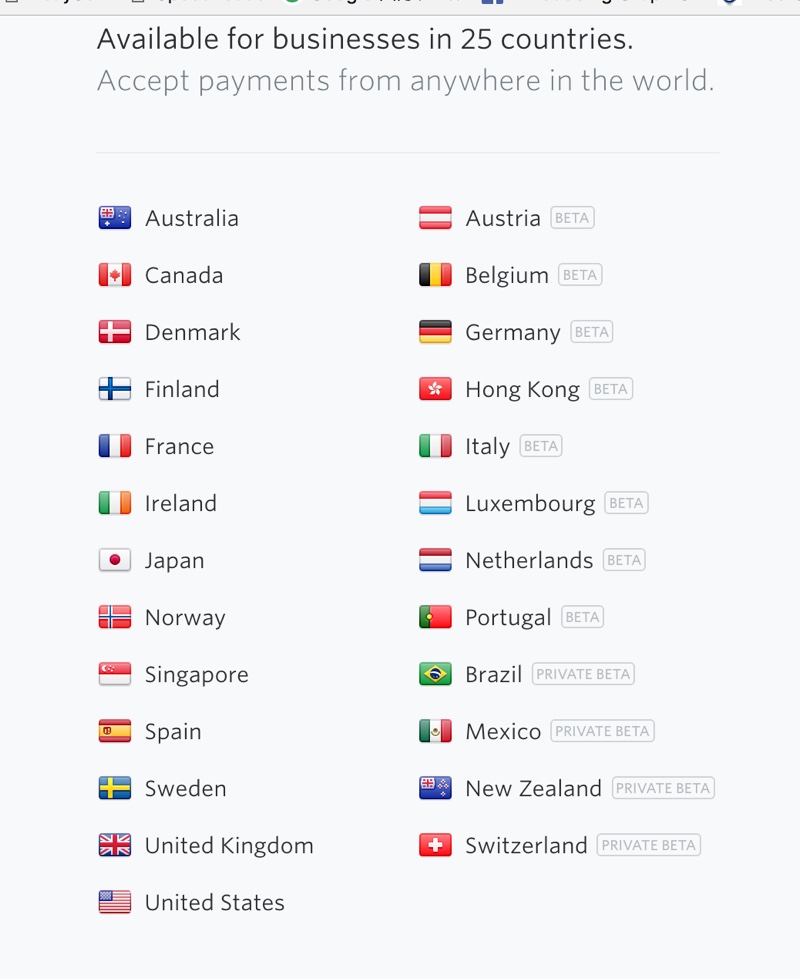

You can use Stripe if you live in one of its 25 supported countries:

However, you can accept payments from customers who live all over the world.

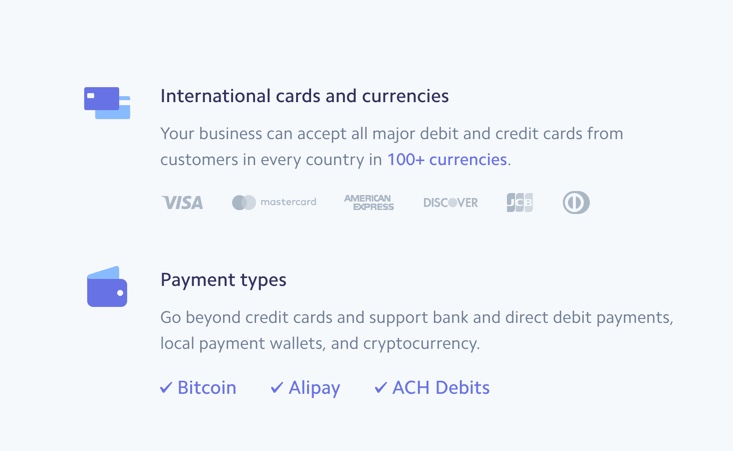

Major Credit Cards Supported

Stripe lets you accept all major credit cards if you live in the United States, including Visa™, MasterCard™, Discover™, American Express™, Diner’s Club International™, and JDB™.

If you live outside of the US, your options are slightly more limited. Australian, Canadian, European, Hong Kongese, Japanese, and Singaporean businesses can accept Visa™, MasterCard™, and American Express™.

In addition, you can accept prepaid credit cards of the same type listed above. You can accept payments from anywhere in the world, and in some cases you may be able to charge your customers in their local currencies. Stripe also supports Bitcoin, Apple Pay, Android Pay, and China’s Alipay.

Recurring Billing

Yes, and there is no additional cost to use this service.

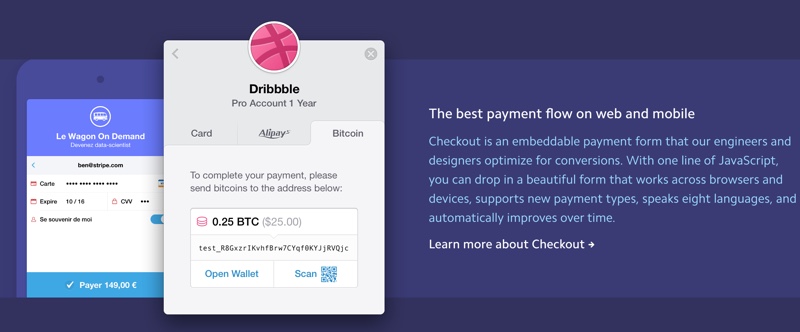

On-Form Payment

Yes, and Stripe offers a beautiful on-form checkout and payment flow solution…

Security and PCI Compliance

Yes, Stripe is PCI-compliant. And with Stripe’s well-built code, merchants can now enable beautiful on-form payment with seamless checkout directly on their sites. Visitors can check out without appearing to leave the site. However, the customers’ sensitive data never passes through the merchant’s site. Instead, it goes securely straight to Stripe. This takes the pressure and liability off the merchant’s shoulders

Do note that your domain will need a security certificate in order to process transactions in this manner.

Can you accept phone orders or manually enter your customers’ payment info?

Yes! You can create a charge manually by clicking on the gray “+ Create Payment” link in the upper right corner above your recent payments list on the payments page.

However, Stripe has made it clear that accepting phone orders or manually entering charges through your dashboard must ONLY be performed when there are exceptional circumstances preventing you from processing charges using the integrated form on your website. In other words, this cannot be the primary method for processing payments on your account.

WARNING: When you manually enter card information into the Dashboard, Stripe isn’t able to verify that you’re keeping this information secure—so you’re responsible for ensuring that you protect your customers’ card information in accordance with the PCI compliance requirements.

What if you don’t have your own Stripe integration set up? In that case you can make use of a secure and reputable third-party integration, such as an invoicing service or online marketplace. This ensures that you’re processing charges in a secure, PCI-compliant manner.

Platform Integrations

With numerous plugins and ease of integrations, Stripe is one of the top all-in-one providers. It is widely used and supported by many platforms. In fact, it powers the payment systems behind companies such as Kickstarter, Shopify, Squarespace and more.

To find out if Stripe works within your existing business infrastructure, see their extensions and integrations here.

Mobile Payments

Can you accept Stripe payments from your customers in person using your mobile phone?

Yes, you can. You’ll need to use the Shopify POS , or you can choose other 3rd party solutions listed here .

Credit Card Data Portability

Can you export data if you decide to leave the platform?

Yes. Stripe will ask for the PCI-compliant provider to specify which data should be transferred. Best of all, there is no fee associated with this export.

Can you import card numbers from your existing provider to this provider?

Yes, in most cases this is possible. You’ll need to check with Stripe customer support to see if it will work in your particular case. Stripe tells us that their “strong preference with these migrations is to receive the customer data directly from your previous payments provider so as to take the burden off you and to keep everything PCI compliant.”

Who Can Use This Payment Gateway?

Many online business owners enjoy using Stripe, especially since it’s so easy to set up and is very powerful for the price. In fact, Stripe is a favorite payment gateway provider of many SAAS providers.

Their API is well-documented, easy-to-use and has a good reputation with SAAS providers and developers. Plus with the ability to save credit card information for future use, recurring billing is fairly easy.

If you don’t want to touch code, you don’t have to. That’s because there are many plugins that integrate with WordPress, WooCommerce and many other popular platforms. In many cases, all you need to do is enter your Stripe keys, and in just moments you’ll be ready to accept payments.

Now having said that, not every business can use Stripe as their gateway. Stripe prohibits businesses that deal with adult content, get rich quick schemes, unauthorized goods, regulated goods, gambling, MLMs, social media followers, and many other high-risk businesses.

Before you consider Stripe, be sure to check their list of prohibited businesses here. Also make sure to read their terms here.

What Type Of Support Is Offered?

You can reach Stripe’s customer support via email. If you’re a developer, you also have the option of reaching them through an IRC chat.

Please note that Stripe does NOT offer telephone support. This lack of telephone support and live chat may be a deal-breaker for some business owners.

Also, do note that they provide a comprehensive how-to guide and other documentation.

What Type of Reputation Does The Provider Have In The Market?

Stripe was founded in 2010 with a service tailored to merchants with access to web developers who want to customize the application according to their specific payment needs. And in that respect, Stripe has done extraordinarily well. They are easy-to-use, and we love the smart and beautiful check out flow.

They have a BBB Business Review with an A+ rating. At the time of this writing, there are 362 complaints in the last three years, with 135 complaints closed in the last 12 months.

However, a quick search online shows that Stripe does have negative reviews around the web. The common issues we see are related to sudden cancellation of merchant accounts, reserves behind withheld without notice, and difficulty reaching customer support.

Some of these issues may be due to the fact that Stripe makes it exceedingly easy to set up an account. They don’t have any set up fees, monthly fees or monthly minimum charges. So that means just about anyone can set up an account and be ready to go in minutes rather than days. The downside is that this apparent ease may also attract high-risk businesses, which may the ones who are having their accounts canceled and funds withheld.

That’s speculation, of course. However, we will say that our experience with Stripe has always been good.

To learn more and to see if Stripe is a good fit for your business, check them out by clicking the button below. At http://promotelabs.link/Stripe

Now let’s wrap things up…

Conclusion

Overall, these five payment gateways tend to have good reputations and plenty of features. Some of these options, such as Amazon and PayPal, offer your customers piece-of-mind with a trusted brand, plus the added convenience of paying with their Amazon or PayPal accounts. Still others offer beautiful on-form payment options so your customers have a seamless experience. And as noted, fees can vary with these providers, so it’s a good idea to understand all the fees before you sign up with any specific provider.

Here are the direct links so you get more information and make your final choices… Just click the images below:

DOWNLOAD & SAVE THIS POST >> CLICK HERE <<

DOWNLOAD & SAVE THIS POST >> CLICK HERE <<